Ethereum Price Prediction: Technical Strength and Fundamental Catalysts Signal Bullish Reversal

#ETH

- Technical Strength: MACD bullish divergence and Bollinger Band support suggest upward momentum despite current price below moving average

- Fundamental Catalysts: Record stablecoin supply, institutional whale accumulation, and Layer-2 innovation drive long-term value appreciation

- Risk-Reward Profile: Current levels offer favorable entry with strong technical support and multiple growth catalysts ahead

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Divergence Despite Short-Term Pressure

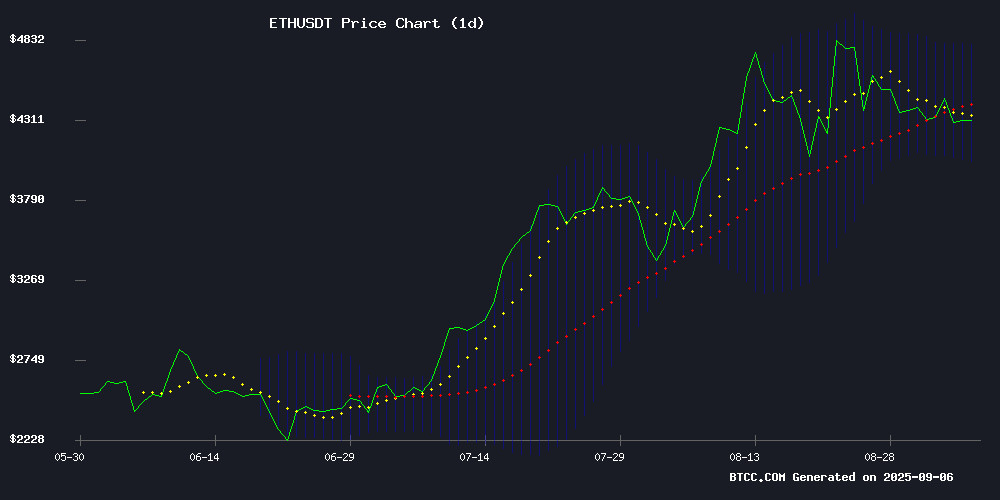

Ethereum is currently trading at $4,274.30, sitting below its 20-day moving average of $4,421.59, indicating short-term bearish pressure. However, the MACD indicator reveals a bullish divergence with a positive histogram of 130.12, suggesting underlying momentum remains strong. The Bollinger Bands show ETH trading NEAR the lower band at $4,039.62, which often acts as a support level in bullish markets.

According to BTCC financial analyst James, 'The technical setup presents a classic buy-the-dip opportunity. While price action shows temporary weakness, the MACD bullish crossover and proximity to lower Bollinger Band support suggest accumulation opportunities for long-term investors.'

Market Sentiment: Institutional Demand Offsets Short-Term Selling Pressure

Recent news FLOW presents a mixed but ultimately constructive picture for Ethereum. While phishing scams reached 2025 highs and long-term holders have been selling, several bullish catalysts dominate the narrative. Ethereum's stablecoin supply hitting record highs, institutional whale accumulation, and innovative developments like Vitalik Buterin's backing of new L2 solutions create strong fundamental support.

BTCC financial analyst James notes, 'The market is experiencing typical bull market profit-taking amid strong underlying demand. Record stablecoin supply and institutional interest provide a solid foundation for the next leg higher, despite short-term outflow concerns in ETF products.'

Factors Influencing ETH's Price

Phishing Scams Hit 2025 High with $12.17M Losses in August

Cryptocurrency phishing scams surged dramatically in August 2025, with losses reaching $12.17 million—the highest monthly total this year. Over 15,230 users fell victim, marking a 67% increase from July and the first time monthly victims exceeded 10,000 in 2025.

A single whale account lost $3.08 million in aEthUSDT tokens on August 6 after approving a malicious transaction. Three high-value victims alone accounted for 46% of total losses, including one user drained of $1.54 million through an EIP-7702 batch-signature exploit.

The resurgence follows a mid-year lull when June losses bottomed at $2.8 million. EIP-7702 related scams now dominate attack vectors, with ScamSniffer's data showing sophisticated signature-based thefts outpacing traditional phishing methods.

Why Is Ethereum Rallying? ETH Stablecoin Supply Hits Record High

Ethereum's recent price surge appears tied to a combination of robust on-chain stablecoin growth and bullish technical indicators. The supply of stablecoins on the ethereum network has reached an all-time high, signaling increased liquidity and investor confidence in the ecosystem.

Historical chart patterns suggest ETH may be entering a new phase of accumulation, with key resistance levels being tested. Market participants are watching for a potential breakout as institutional interest in Ethereum-based financial instruments grows.

BullZilla Emerges as Top Crypto Presale for 2025 Amid SPX6900 and Hedera Rally

Cryptocurrency presales are increasingly attracting investors seeking high-growth opportunities. BullZilla, SPX6900, and Hedera have distinguished themselves as standout options for 2025, each offering unique value propositions and substantial return potential.

BullZilla, an Ethereum-based meme coin, leverages innovative tokenomics to drive scarcity and long-term holder rewards. Its Roar Burn Mechanism systematically reduces token supply, while the HODL Furnace incentivizes staking—a dual-pronged approach to value appreciation.

The broader market rally underscores growing confidence in alternative crypto assets. While established projects like Hedera demonstrate steady growth, emerging presales like BullZilla and SPX6900 capture attention with aggressive ROI projections reaching up to 20,000%.

Crypto Phishing Scams Surge 72% in August, Stealing Over $12 Million

Blockchain security firm Scam Sniffer reports a sharp 72% month-over-month increase in crypto phishing scams, with losses exceeding $12 million in August. The number of victims also rose by 67%, highlighting growing vulnerabilities in the ecosystem.

Nearly half of the losses—$5.62 million—came from just three high-value accounts, or 'whales,' with one individual losing $3.08 million. Ethereum's EIP-7702 standard has been weaponized by attackers, enabling sophisticated thefts through smart contract-like functionality for externally owned accounts.

Wintermute's data reveals over 80% of delegate contracts tied to EIP-7702 are malicious, compromising 450,000 wallets since its implementation. The standard, designed to improve wallet flexibility, has unwittingly become a tool for fraud.

Linea Airdrop 2025: Claim Tokens to Power Ethereum’s Next Decade

Ethereum marks a pivotal milestone with its 10-year anniversary, setting the stage for its next phase of growth. Consensys, under the leadership of Joseph Lubin, unveils the Linea airdrop as a strategic initiative to bolster Ethereum's ecosystem.

The airdrop represents a forward-looking effort to incentivize participation and innovation within the Ethereum network. This move aligns with broader industry trends of leveraging token distributions to drive engagement and scalability.

Ethereum ETFs See Second-Largest Daily Outflow Amid Market Turbulence

Investors pulled capital from Ethereum exchange-traded funds at the second-highest daily rate since their July 2024 launch, signaling waning appetite for crypto exposure. BlackRock's ETHA led the retreat with $307.68 million in withdrawals—nearly 70% of the day's total outflows.

The September 5 exodus extended a five-day bleeding streak that began August 29, with nine ETH ETFs collectively shedding $952 million. Grayscale's products bled $80 million while Fidelity's FETH lost $37.77 million. Derivatives markets mirrored the stress, with ETH futures seeing $570 million more sell orders than buys—a pattern historically preceding local tops.

Vitalik Buterin Backs Ethereum's New L2 Codex Amid Stablecoin Payment Debate

Ethereum co-founder Vitalik Buterin has publicly endorsed Codex, a stablecoin payments-focused LAYER 2 solution, calling its positioning 'impressive' and highlighting its synergy with Ethereum L1. The endorsement comes as Stripe's Tempo announcement—a competing L1 payment chain—sparked criticism of existing L2 networks' ability to handle stablecoin traction.

Experts remain divided on whether Codex can revive interest in Ethereum L2s as the optimal infrastructure for stablecoin chains. Fundstrat's Tom Lee and Lightspark's Christian Catalini suggest it's too early to declare winners, citing regulatory uncertainties reminiscent of the failed Libra project.

The stablecoin payments space is heating up, with Ethereum L2s facing scrutiny over scalability. Buterin's support signals Ethereum's push to reclaim narrative control in the evolving stablecoin infrastructure race.

Ethereum Price Prediction: Institutional Demand and Whale Accumulation Signal Bullish Reversal

Ether traded at $4,300 over the weekend, marking a 2% decline. Despite the pullback, institutional inflows and whale activity suggest underlying momentum for a potential reversal. Short-term volatility remains, but technical indicators point to ETH testing higher resistance levels soon.

Institutional support for ETH is evident, with approximately $450 million flowing into ETFs. BlackRock and other major players are driving demand, signaling long-term asset positioning rather than speculative trading. This institutional participation provides stability and reinforces ETH's place in mainstream portfolios.

While $446 million in ETF outflows were recorded recently—the largest since August 4—the market context differs from historical patterns. Aggressive selling typically appears NEAR local tops, but current conditions suggest a divergent scenario.

The convergence of whale accumulation and institutional interest creates a foundation for sustainable upward movement once key resistance levels are breached. Retail investors are also taking cues from large-scale adoption, adding further validation to ETH's market position.

Ethereum Long-Term Holders Sell Heavily: Is Price About To Suffer?

Ethereum faces mounting pressure as long-term holders (LTHs) accelerate profit-taking, a behavior historically linked to market reversals. The LTH Net Unrealized Profit and Loss (NUPL) metric has crossed the critical 0.65 threshold, signaling saturation in profit-taking and potential stagnation. With Coin Days Destroyed (CDD) spiking to a two-month high, seasoned investors are offloading holdings, casting doubt on ETH's near-term momentum.

Current price action reflects cyclical patterns, with ETH struggling to maintain upward traction at $4,294. Absent substantial demand from new buyers, the asset risks prolonged consolidation. Glassnode data underscores the divergence between LTH exits and retail inflows—a dynamic that typically precedes cooling periods in bull markets.

Web3 Hackathons Surge as ETHDenver, Hedera Africa, and Unite DeFi 2025 Drive Innovation

The blockchain hackathon ecosystem is experiencing unprecedented growth in 2025, building on the explosive expansion seen in 2024. Major events like ETHDenver 2025, Hedera Africa, and Unite DeFi 2025—partnered with 1inch—are pushing boundaries, offering developers platforms to showcase groundbreaking decentralized finance solutions.

These competitions have become critical launchpads for emerging projects, with participants vying for recognition as potential DeFi unicorns and access to vital funding opportunities. The intensity reflects the sector's maturation as builders race to solve real-world financial challenges through blockchain technology.

Ethereum: Assessing Long-Term Viability Amid Market Volatility

Ethereum (ETH -2.91%) has demonstrated remarkable resilience, posting double-digit gains in July and August before retreating from its all-time high near $5,000. The second-largest cryptocurrency by market capitalization remains a focal point for investors weighing its long-term potential against inherent crypto volatility.

Since its 2015 launch, ETH has delivered staggering 140,000% returns through September 2. The network's dominance in decentralized finance (DeFi) and stablecoin issuance—with the latter market exceeding $280 billion—positions it as a blockchain with tangible utility beyond speculative trading.

Market observers note Ethereum's infrastructure advantages, particularly in smart contract functionality that continues attracting institutional interest. While NFTs face uncertain adoption curves, Ethereum's role in stablecoin settlement and DeFi protocols suggests enduring relevance in the digital asset ecosystem.

Is ETH a good investment?

Based on current technical indicators and market fundamentals, Ethereum presents a compelling investment opportunity for both short-term traders and long-term investors. The current price of $4,274.30 offers an attractive entry point below the 20-day moving average, with strong support levels providing downside protection.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $4,274.30 | Below MA - Accumulation Zone |

| 20-Day MA | $4,421.59 | Resistance Level |

| MACD Histogram | +130.12 | Bullish Momentum |

| Bollinger Lower Band | $4,039.62 | Strong Support |

Fundamentally, record stablecoin supply, institutional accumulation, and ongoing Layer-2 innovation create a strong foundation for future growth. While short-term volatility may persist due to profit-taking, the overall trajectory remains bullish for 2025-2026.